70-20-10 savings

By hartnsoul

@hartnsoul (558)

Philippines

June 29, 2009 10:56pm CST

I'm just curious on what you think.

I read this scheme from a book on financial management. I think it's worth sharing especially to those frugal moms out there.

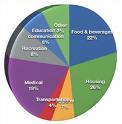

Say you have 100 as salary, you use 70% of that as revolving fund for necessities and everything else. Then you save 20% and put it in money jars or in the bank for savings. Of course, the 10% is what we give to church or to others in need. As the saying goes, 'it's better to give than to receive'.

What can you say about this? Do you think your lifestyle can manage to utilize only 70% of your monthly earnings?

My family practices this and we are comfortable with it. We don't live like paupers but we manage to save and was able to buy some nice things.

Enjoy MyLotting!

1 person likes this

18 responses

@Pigglies (9329)

• United States

30 Jun 09

That sounds absolutely crazy to me. At one point, I made barely any money and I managed to donate 30% of my income to animal rescue. But I don't just set aside money for donation. I just kind of donate as it's needed and if I can spare it. I do volunteer a bunch, and usually that's where my donations go too, to the same places I volunteer.

I would never donate money to a church knowingly/willingly.

@FinanciallySMART (41)

• Jamaica

30 Jun 09

The bible says that giving 10% of our earnings is giving thanks to God. Don't look at it as giving it to the church but as saying Thank You Heavenly Father for blessing me. I would encourage you to try it and you will see the blessings on your life.

@happythoughts (4109)

• United States

10 Jul 09

That is a good plan. Right now we are putting so much towards debt and soon I think that will be gone and we can get a better budget set up. Right now it feels like we give %10 to the church and %91 to bills. Money is tight but I wish we were putting more into savings.

@caver1 (1762)

• United States

2 Jul 09

This is an excellent plan and if savings are invested along the way it will lead to financial security in the future. Once you've started it is easy. Getting started is the hard part. When a family has been living on 100% of their income, it can be very hard to make the change.

@Weezy333 (33)

• United States

3 Jul 09

I totally agree with that idea. In theory it's great, but do people actually do it. Of course not. If they did, there wouldn't be so many people in debt.

I would actually try to save more. Push yourself to the limit. See how little you need to survive. Go to the extreme, then you will see you really don't need to buy all those things you think you can't live without.

The key is to balance it out. Enjoy life, but not at the expense of your financial future and retirement.

@SomeCowgirl (32191)

• United States

2 Jul 09

Right now my fiance and I haven't got any income coming in except for this. However, i think that when we do have an income that flows more we will definitely be saving a bit of money from time to time, maybe on a weekly basis. If one can learn to manage there finances properly then only using 70% of one's income to pay bills and buy groceries would be a cinch. Lol. Great concept and idea!

@Shellyann36 (11385)

• United States

1 Jul 09

I started out saving just 10% for my savings but that does vary monthly depending upon what is going on that month and if I can manage to save more. We just drastically cut our monthly bills back in May when we moved. The rent is 50% cheaper and that has freed up alot of money for us. I hated moving but it has turned out to be worth it. I can understand the 70/20/10 chart.

@feathers26 (865)

• Philippines

30 Jun 09

It's a good idea. I think it would be helpful for everyone.

@sunshine4 (8703)

• United States

30 Jun 09

We could never do it! There are weeks that we are scrimping and scraping to pay off some of our bills. The problem is that we love our toys and we buy them and then have to pay them off. My husband just bought my son a motorcycle, so that is an additional monthly payment. We also have 3 yrs still to pay on our trailer. Once these are paid for, I think we could go with your system. The only thing~ we will probably find something else to play with and want to buy it.

@coffeebreak (17798)

• United States

1 Jul 09

All those ways are good that they tell you about saving and "pay yourself first" etc.....well.. yeah.. in theory you will. Possibly for real too.. but what happens when you pay yourself first, or in this case spend you 70% on necessities and living expenses... and then do you 20/1-% things... and you still have a necessary bill that has not been paid because the 70% didn't go far enough? What do you do... pay the electric bill or pay your full 20% to savings or to the church? Or just say "well, my 70% is gone, the electric bill has to wait" and next month you will at least have a late charge added to it and if you couldn't afford the lessor bill last month.. how do you think you will be able to pay even more next month?

I think it is a good theory to start with, but you have to use it practical. I think that if you pay your bills first and stop SPENDING to make more bills or the ones you have higher... and then anything that is left goes to savings. Then when you see your savings is not growing much... that is almost more incentive to do something about hte money you are spending... do you really need Starbucks every morning? Do you really have to super size everything? People do this kind of stuff every day and figure... It's only a buck... big deal. Well, on a daily basis it isn't, but you save that buck every day... and at the end of the month you have 30 bucks - hey.. now you have enough to pay your electric bill or to add to your savings! and did you even miss not spending it? Most likely not. Save a little to save alot is my motto and it works. I used to do my husband laundry and checked his pockets for changed.. he'd always take the bills, but always left change... I'd collect at least 2 bucks a week in change - that was nearly $10 each month that i had to add to my savings or to get something I needed.

YOu can read my blog in my profile about my money savings tips and tricks.. most tried and true savers... been working these savers for years!

@Ldyjarhead (10233)

• United States

30 Jun 09

It's a very good plan and in theory it should work well for everyone. There are those that are so in debt now that saving a bit is a great idea, but more should be going to pay down the debt which will allow for more savings later, instead of interest fees.

There are also those that are living as cheaply as possible and still can't make ends meet, much less put 20% in savings. I absolutely agree that we should strive for that, but there are situations where that is just impossible or you wouldn't be able to pay your regular bills.

Yep, give up the latte and pack a lunch instead of spending $10 every day and put that in the jar. It adds up quickly!

@scheng1 (24650)

• Singapore

30 Jun 09

Hi hartnsoul, I think for most families with school going children, this 70-20-10 will work.

However, when the mortgage is fully paid, and the children have graduated from college, it should be 40-50-10, to spend only forty per cent, and save fifty per cent, otherwise there is not enough time to save up for retirement.

That's why in financial management course, the importance of personality and age are very important factor.

@janiceines (799)

• Singapore

30 Jun 09

i think it's quite difficult for my family to do that but it's a very good idea and i think i will try to work its out , we usually don't have any saving , we spent all the money every month , everything need money , school fees, electric bills, phones bills, house load etc ......., people alway say only oxgyen is free

@sublime03 (2339)

• Philippines

30 Jun 09

I can agree that we use 70% of what we earn for daily use/necessities but sometimes we tend to use up to 80% when we see things we are not supposed to buy. It is actually easy to segregate it with 70-20-10 if you are obedient enough to do it every pay day. I know alot of people who tend to go with what they think is enough to keep while some do not even save any of their money like young, single people who have nothing to do but party every night.

@jazel_juan (15747)

• Philippines

30 Jun 09

wow, it would really be nice if i could do something like this. bu reality is that my salary and my husband's salary is low and there is barely enough.. but lately we are able to save some money but then just last sunday we are able to utilize almost all of it..:(( because my daughter got sick and we have to bring her to the doctor and have her checked. and with the meds it is pretty pricey. just now, i had my salary and it is barely enough..so i do not think i could save some today.

@Ritchelle (3790)

• Philippines

30 Jun 09

i think the revolving fund of a family budget depends on the amount of salary that the family accumulates in a month's time. there are different formulas for this type of budgeting. there is the so-called 60-40 wherein 40% goes to savings. there is the type of budgeting that no matter what only 10% of the budget goes for personal wants. i think what is very important is there is money put aside not just for rainy days but also for investment purposes

.

.

.

. @gdesjardin (1918)

• United States

30 Jun 09

My dad always used this method. I was raised that way and when I got married we used to use that method (or atleast try really, REALLY hard to stick to that method). I recently lost my job so we are unable to continue to use that method as we are barely squeaking by...but I definitely would advise people to strive to use this method.

@khayshenz (1384)

• United States

30 Jun 09

I like that - I REALLY like that. I think I'm gonna start working within that framework. I'm not a mom yet, not even married yet. Embarrassingly, I'm one of those in their mid-20s buried in depth and slowly crawling my way out. I really don't wanna bring this debt with me to marriage. So I'm planning to pay it off before I get married.

At this point - I'm not capable of the 70-20-10, just because everything is sort of going to credit card companies. I do save- for the rainy days. That way I don't use my credit cards for "emergency funds." =/