Living on a budget

@pcunix (210)

Middleboro, Massachusetts

October 11, 2015 2:58pm CST

When my wife and I were first married, we had very little money. I think our income was a little over $100 a week. Of course things were cheaper then; our rent for a large ground floor apartment was just $75 a month and a pizza we'd share once a month was $1.10. Still, it wasn't easy to make ends meet, so we maintained a paper budget. I still have some of those old budgets and it does bring back memories to look at them.

Things got better quickly. I'm not saying we were wealthy, but we always had enough to pay our bills. We bought a small house and new cars. We had to be careful with our money, but there was no need to budget stringently. There was always money left over.

Now, we are mostly retired. Our income is half what it used to be. It's enough - we are not poor and we do enjoy ourselves, but we do have to budget again. We set limits on things like entertainment and even grocery shopping.

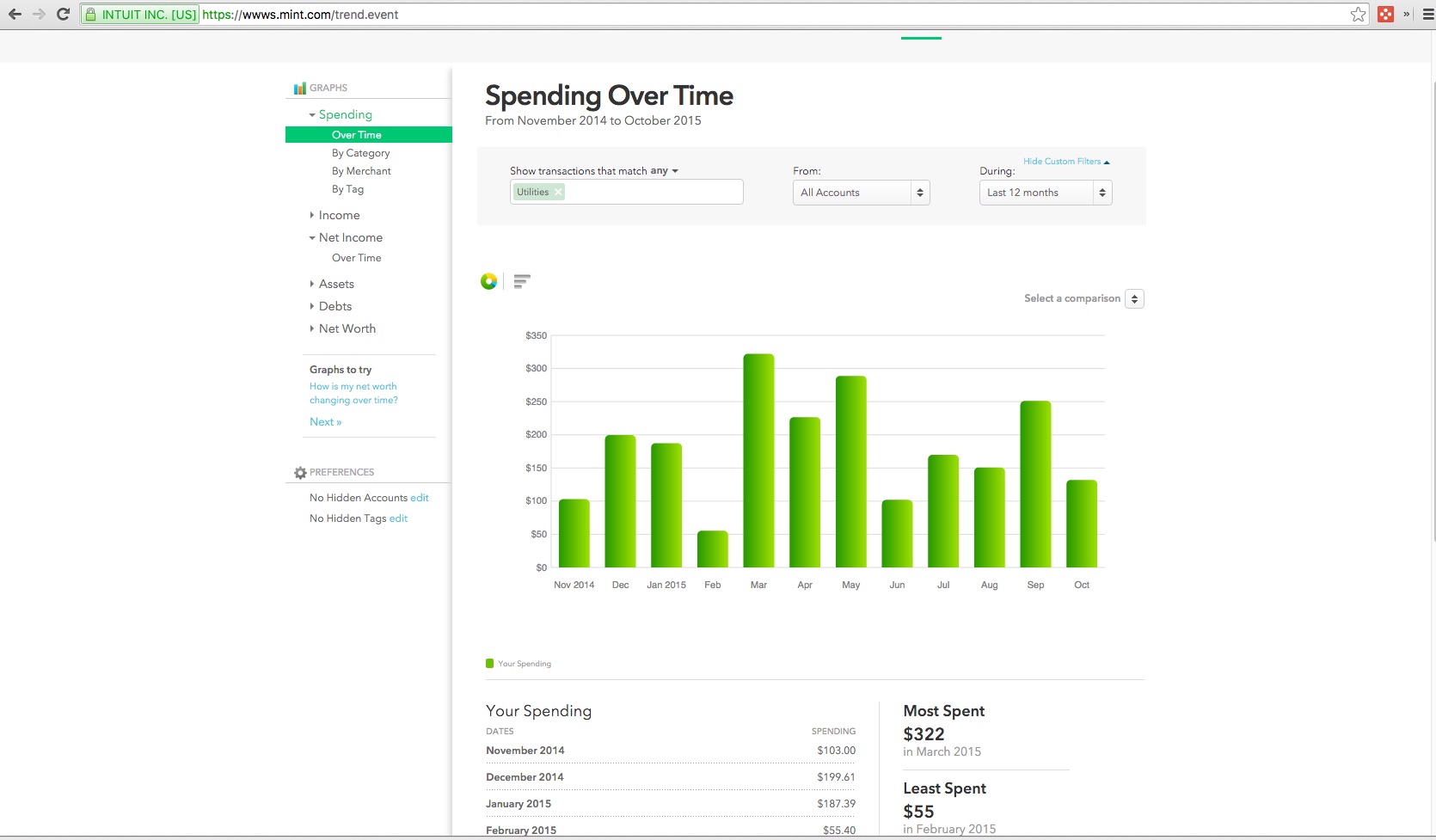

I use Mint.com to do this. It watches all of our bank, credit card and investments. It lets me categorize each expense and post them against the budgets we have set. At a glance, we know if we can afford to splurge on an expensive night out or buy new clothes. It's far easier than our old paper budgets ever were.

There are other programs similar to Mint, but they seem to have the best reputation. They are owned by Intuit, the same folks who make Quickbooks and Turbotax. When people new to Mint ask me about it, I do recommend it, but I suggest just setting it up and letting it run for several months before setting strict budgets. It can be surprising to see how much you spend in certain areas and often things pop up that you have totally forgotten about. I let my Mint run for three years before I laid down final budgets!

If you need to budget, or think you may need to soon, I recommend this.

12 people like this

15 responses

@vandana7 (98718)

• India

12 Oct 15

You did well. :) Small house..is the first priority. I have a slightly different way. I have home expenses, medical expenses, asset repair or asset replacement expenses, contingency funds, and entertainment. All equal. Therefore, if home expenses increase, others have to be balanced from whatever I can save. :)

1 person likes this

@pcunix (210)

• Middleboro, Massachusetts

11 Oct 15

Mint has mobile apps also, but you don't need to enter anything - it pulls purchases from your accounts. The only time you need to do anything manually is if you spend cash.

@softbabe44 (5816)

• Vancouver, Washington

12 Oct 15

i had to budget alot when i first got married also but that does bring back memories lots of good memories

@JaneApril (334)

• Philippines

12 Oct 15

Lots of really good memories! It also made our relationship stronger.

1 person likes this

@katsmeow1213 (28717)

• United States

12 Oct 15

We have mostly lived paycheck to paycheck, so we just do our budget up for each week. We each pay one of the monthly bills out of each paycheck. He is paid weekly so takes the smaller ones. I'm paid biweekly so I take the larger ones. After that bill is paid we can use whatever is left over however we like. We mostly use his money for spending, my money is put towards savings and debts.

1 person likes this

@pcunix (210)

• Middleboro, Massachusetts

23 Nov 15

That's not always possible, but if you can, yes.

@JaneApril (334)

• Philippines

12 Oct 15

Wow! Hope we survive and end financially great like you do.

1 person likes this

@crazyhorseladycx (39515)

• United States

12 Oct 15

sounds most familiar, those younger days. i fear the hubs doesn't know what a budget is 'n spends like the wind. on the other hand, i'm a penny pincher 'n always 've been. i still do mine'n paper. interestin' budget thingy though 'n i'll pass that info onto the daughter...who really needs such.

1 person likes this

@Pinakikrishshna (14)

• Kolkata, India

12 Oct 15

Living on a budget is a good habit. I never indulge in exceeding the budget (which I do manually) but I will now go for Mint, just to test if it helps me in anyway.

1 person likes this

@JaneApril (334)

• Philippines

12 Oct 15

Presently going through it.

We are newly weds, need to cut off a lot, but gladly .. we're doing okay because my husband is good in handling money, unlike me :)

We're now saving for our upcoming baby.

1 person likes this