Inflation DOES Have At Least One Silver Lining

By Jim Bauer

@porwest (78757)

United States

October 12, 2023 7:28am CST

Inflation is bad. It hurts the poor more than anyone. But it's here to stay, at least for a while longer. Maybe a year or two. Who knows?

But there is at least one silver lining. That is, if you are a saver.

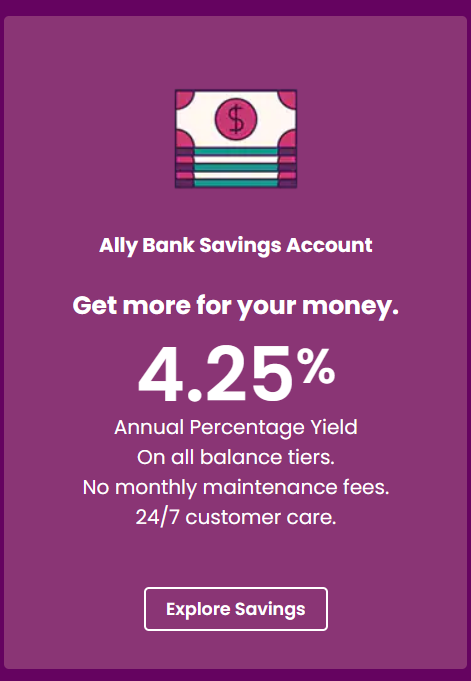

Nowadays we have quite a few more options when it comes to the types of bank we can choose, and if one chooses an online, high yield savings account, they are going to fare better than anyone else.

My Ally high yield savings account, for example, pays 4.25% interest right now, and just yesterday one of my 12-month CD's renewed at 5%.

It still won't beat inflation, but at least when it comes to what I keep in savings, which granted is a small portion of my total bottom line, it gives me at least a tiny leg up to recoup more than most.

Which brings me to an interesting tidbit on this. There was a survey conducted that said that only 19% of high income earners are earning more than 3% on their savings. The stats for poor people? Abysmally lower, meaning not only are poor people getting socked in the eye with inflation, they aren't even getting any bang for any bucks they do have.

If you want to at least have some shot against this budget killing inflation, looking into opening a high yield online savings account may be just what the doctor ordered, and is definitely worth a peek.

16 people like this

12 responses

@LindaOHio (158688)

• United States

12 Oct

Yes, I've noticed the high-yield % especially with online accounts. Hubs doesn't trust online accounts and wants a real brick-and-mortar bank to deal with. We haven't done anything with our money; and we should. Have a great day.

2 people like this

@LindaOHio (158688)

• United States

12 Oct

@porwest I know that; but you can't tell him that. I'd be interested in Ally.

3 people like this

@porwest (78757)

• United States

12 Oct

@LindaOHio lol. Stuck in his ways? I can't say I am not that way a bit too. You know how long it took me to ditch the DVD's from Netflix and go to streaming? lol

2 people like this

@RebeccasFarm (86976)

• United States

13 Oct

@jstory07 Yes that is why I was asking Judy..

1 person likes this

@jstory07 (135149)

• Roseburg, Oregon

13 Oct

@RebeccaFarm I think poor means different things to different people.

2 people like this

@porwest (78757)

• United States

14 Oct

To me, poor is when you do not have the ability to make financial decisions on your own behalf, but rather are forced to make decisions based on your financial limitations. In other words, your expenditures are greater than your means, and you have no ability to rectify the situation. You don't live where you choose. You don't get to go places you want to go.

In a nutshell, when money determines for you what you can do and when you can do it and why you do it? You are poor.

If you can choose for yourself and have the means to do what you want, when you want, on your own terms and no one else's? Then you are not poor.

1 person likes this

@marguicha (216456)

• Chile

12 Oct

I mostly save by being reasonable. I have big lights but lights are out in my house if I´m not in a room. And I don´t throw away leftovers. As for meds, there are some pills that are less expensive if you buy generics. I have found out that it is worth it to buy few clothes but good ones. And I bend down if I see a penny

2 people like this

@marguicha (216456)

• Chile

12 Oct

@porwest I don´t technically have to save that way either. But for me it is absurd to throw away anything. Why have lights on if I´m not on a room? Why cook more food that you will eat? And if you make more, why not put it away instead of wasting it? In my house, if there is any food I will not eat, Luna will be happy because they will become her snacks.

2 people like this

@porwest (78757)

• United States

12 Oct

Definitely the way to go on all counts. I save in any way I can even if I don't technically have to. But then, part of the reason I don't have to is because I have spent a lifetime paying close attention to money and working hard to keep as much of it as I can.

2 people like this

@porwest (78757)

• United States

14 Oct

@marguicha That's what makes rich people rich, believe it or not. Even if you do these things and don't become rich, you are still richer than someone who doesn't do these things. The problem with many people is that they earn $100 and spend $150. If you earn $100 and spend $75, you are miles ahead of the other guy. Even if you spend it all, you're STILL ahead of the other guy.

A man who minds his pennies has pennies to spare while one who does not mind his pennies must always seek more pennies.

1 person likes this

@allknowing (130292)

• India

13 Oct

Even here in India the deposit rates have increased and I think it is 7% now

2 people like this

@allknowing (130292)

• India

14 Oct

@porwest Not many years ago it was 14 percent

1 person likes this

@amitkokiladitya (171935)

• Agra, India

12 Oct

I don't think that is available innmy country. Actually the interest rates of banks have reduced

2 people like this

@amitkokiladitya (171935)

• Agra, India

17 Oct

@porwest every country has different rules but recession and inflation iis getting common to all

1 person likes this

@porwest (78757)

• United States

17 Oct

@amitkokiladitya Yep. So far as I am aware everyone is sort of in similar boats when it comes to the economy.

@1creekgirl (40650)

• United States

12 Oct

We recently opened a couple of CDs at our credit union and the interest rate wasn't bad.

1 person likes this

@moffittjc (118820)

• Gainesville, Florida

14 Oct

I just moved a thousand from my savings at my local credit union to a 13-month CD paying 6% interest. I also have a savings account with Ally, it's where I keep my emergency funds. I've always been impressed with their interest rates, even when interest rates were barely existent.

1 person likes this

@moffittjc (118820)

• Gainesville, Florida

15 Oct

@porwest Even when it was below 2%, Ally was still paying better than traditional banks

1 person likes this

@porwest (78757)

• United States

15 Oct

@moffittjc Yes. It was. Even at 0.50% it was better than traditional banks. I have been with them for many years and they have my business. I am very happy with them. Not going anywhere anytime soon. Right now I have way too much in cash, but I am keeping it for the potential crash or major correction coming so I can make sure to capitalize on it. But honestly, I am earning more interest on my account than a lot of dividend stocks right now.

Speaking of stocks (or should I say REITS?) I have been buying Realty Income (O) like crazy. SOLID dividend aristocrat that has always delivered that's being beaten down simply by external factors. It's a WILD sale on shares right now.

That's NOT a recommendation by the way.

***Disclaimer: I am not a financial advisor and any information offered here is merely my opinion and for entertainment purposes only. Individual investors should do their own due diligence or seek the advice of a professional financial planner or advisor before making any decision on a particular investment or strategy,

Just in case there are lawyers among us.

1 person likes this

@aninditasen (15804)

• Raurkela, India

12 Oct

I do save and invest some amount but the way prices are increasing I doubt for how long it's going to be possible.

2 people like this

@porwest (78757)

• United States

12 Oct

To me saving is always possible. It simply requires life adjustments. Or even increasing investments. Dividends and interest are a way to add income and hedge against inflation. Granted, depending on one's situation it can be difficult. But I think there is a higher cost to not doing it than doing it.

1 person likes this

@Beestring (13486)

• Hong Kong

12 Oct

As HK dollar is pegged to US dollar, when US raised interest rate, HK follows suit. Right now, we can earn 4.5%-5% interest for our fixed deposit with banks. Our inflation rate is 2-2.5%, putting money in bank does help to beat inflation.

1 person likes this