Tuesday Challenge 03/18/25

By Jim Bauer

@porwest (102308)

United States

March 18, 2025 7:35am CST

Yep. The Tuesday Challenge lives on, I just haven't talked about it in a while. Has anyone done it yet? How much is in your envelope?

I did change things up a bit in October of last year which was the one year anniversary of starting it. I began paying myself 10% interest on the balance and adding that payment to the 1st Tuesday of each month. I also started what I call "plus one," which is basically just adding $1 more to the weekly required contribution amount.

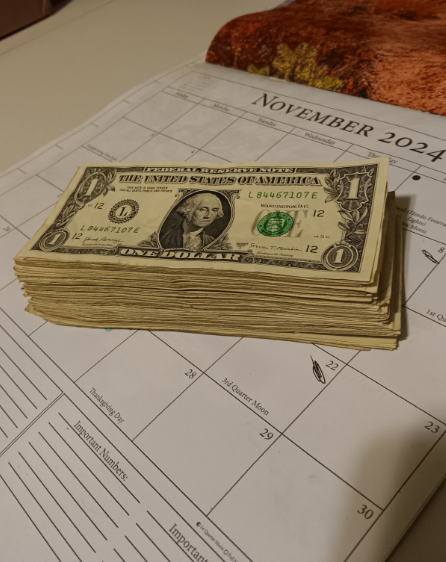

To date I have $1,281 in my envelope.

As I always say, it's not life changing money. It's just a fun way to find a way to force yourself to save something and get the habit of saving started.

***VIDEO IS NOT MONETIZED!!!***

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

5 people like this

2 responses

@moffittjc (124767)

• Gainesville, Florida

19 Mar

Awesome, as always! What did you do with all the money you saved last year? And do you have an end goal in mind with all the money you save? I have been investing mine. I assume you are planning on investing yours as well?

1 person likes this

@moffittjc (124767)

• Gainesville, Florida

10 May

@porwest I would assume you budget for food elsewhere in your finances and not in the money you are trying to save in your envelope. I don't touch the money I set aside in my envelope unless it is for two reasons: one, it's an absolute emergency; or two, I am moving the money into some type of investment account.

1 person likes this

@porwest (102308)

• United States

11 May

@moffittjc Generally speaking, money spent comes from proceeds from investments and other strategies. I have tried to make it so that a paycheck is unneeded, but a bonus if one comes in. So, we have a system for spending a portion of dividends (50%), proceeds from short term strategies such as short term investment positions with a specific return in mind, short selling, and covered call options contracts we sell on underlying shares (with the intention of not selling the shares) to produce income, which also has set parameters as to how much generated can be put into the "budget" for bills and other spending. Generally speaking, the principal is rarely touched, so what we essentially achieve is income AND growth, and of course the growth produces more as it grows and depending on how it is reinvested to produce more income.

The system mostly works in our favor. But like most things, it's not 100%. Say, for example, when the market corrects or is more volatile, it's much harder to safely deploy certain strategies to produce the same results...

So, because of that, there's also a cushion in savings we keep specifically to make up the difference when the time comes that it is needed.

1 person likes this