Find Your Number

By Jim Bauer

@porwest (109244)

United States

October 13, 2025 9:29am CST

What is retirement? It's really just a number that is preceded by a question. "How much do I need to comfortably live?"

Is it a highly advanced mathematical equation you need to use?

No. Not at all.

The easiest way to find your number is to use the Rule of 25. It's as simple as it gets.

How much do you make in a year, and is that what you want to retire with? Let's say you need $60,000 a year to live comfortably. Multiply that by 25 and you come up with $1.5 million. That's your number. In order to generate $60,000 a year from interest and dividends, you need to save $1.5 million.

Is $40,000 your number? Times 25 that's $1 million.

Are you ambitious or do you need more? Maybe your number is $100,000 a year. You will need to save $2.5 million.

Now, what is the final number based on? Another rule. The 4% rule. This rule states you can comfortably withdraw money at a rate of 4% each year from the total and your money will last forever assuming your money is earning at expected annual rates of return, such as based on the average lifetime returns of the S&P 500.

Once you know your number, you can begin the process of determining how to get there. Can you ask for a raise? Can you cut some expenses? Can you increase your interest or dividend return rates? Can you take on an extra job or do a side gig to accumulate the needed money? Can you increase your 401k contributions 1% or 2%?

The first step to getting where you want is knowing where you need to go, and it's best to use a map that shows you the roads and highways that will get you there rather than just blindly drive around in circles before you figure it out...

Or get lost.

When you find your number, it becomes something you can see, and it gives you something real and tangible to work with. Once you know, you know, and it offers you a real destination.

5 people like this

3 responses

@lovebuglena (47941)

• Staten Island, New York

13 Oct

Thank you for educating us here.

1 person likes this

@lovebuglena (47941)

• Staten Island, New York

6h

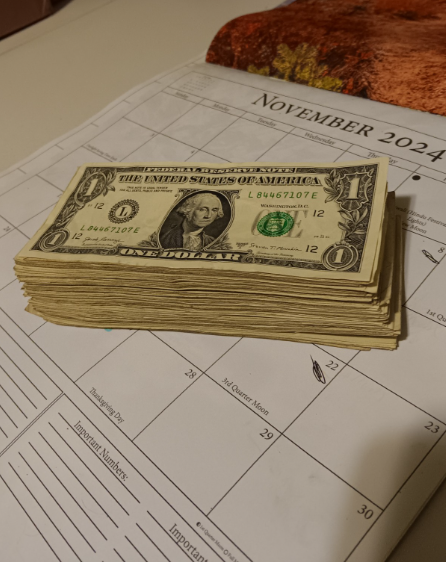

@porwest you get your two cents for sharing your two cents.

@LindaOHio (203277)

• United States

14 Oct

I retired unexpectedly at 62. Fortunately we were prepared. Good explanation for those still working.

1 person likes this