Interest rates vs stock prices

@redyellowblackdog (10629)

United States

March 20, 2007 9:44am CST

It has been long known that as interest rates change often times the stock market goes in the opposite direction. When interest rates go UP, many times the stock market goes DOWN. When interest rates go DOWN, many times the stock market goes UP.

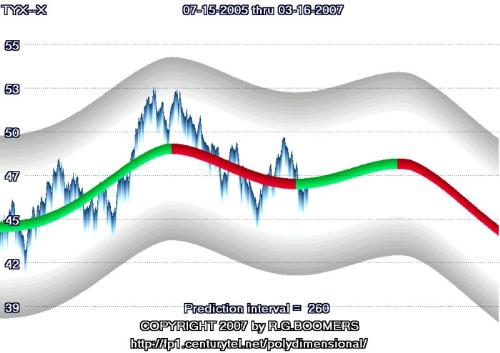

With that in mind I have calculated a projection of trading range and trend for the US 30 year Treasury Bond Yield for the next year. Click on the attached graphic to view.

This projection shows this long term interest rate going UP just slightly for the next 6 months and then down just slightly more for the 6 months after that.

This would translate into a stock market mostly moving sideways for the next year, but slightly DOWN the next 6 months and then slightly UP the 6 months after that.

Do you think a projection of the US stock markets moving mostly sideways over the course of the next year is a reasonable projection?

What is your prediction? Why?

1 person likes this

2 responses

@VKXY62 (1605)

• Australia

22 Mar 07

Hmmm, based on what you have said at the beggining, that seems to make sense, if rates go up, the stock market goes down because people have less disposable cash. They are retaining it for living.

Their own morgates probably affect this more than any other factor, is that into your calculations as well?

When interest rates fall, it stimulates the economy, people have more disposable cash and they are prepared to splash some around the stock market in a gamble or deposit some stuff as a stash or make an income from an egg.

Would it be that homeowner mortgages are given out and that the interest rates applied are worked out against how much they can get out of you for a house while keeping their fingers in your wallet or purse for as long as they can, like most of your working life?

@redyellowblackdog (10629)

• United States

23 Mar 07

Pretty much at any given moment there is only so much money available to be invested. The law of supply and demand in combination with the ever present desire to maximize profit is at work.

The higher interest rates are, the more money will be drawn in that direction, leaving less for stocks. The lower interest rates are, the less money will be drawn in that direction, leaving more for stocks.

It is the way of these things.

As to the mortgages, you have that figured out pretty well.

@speakeasy (4171)

• United States

22 Mar 07

Actually, your first statement makes a lot of sense. People with money to invest will put it in the stock market when interest rates are low in order to try to get a decent return on thier investment. When interest rates are high; they pull the money out of the stock market and put it into "safer" investments. Of course, this does make the stock market drop.

Whether, it will follow your projected graph though is anyone's guess. We really don't know for sure what the fed will be doing over the next year. Also, foreign factors are now having a bigger impact on the US stock market. So we will just have to wait and see.

@redyellowblackdog (10629)

• United States

23 Mar 07

"So, we will just have to wait and see."

LOL... I use to write a column about the stock market for a comercial web site, now out of business, and I used that exact quote all the time.

BTW, I agree with the rest of your response, too.